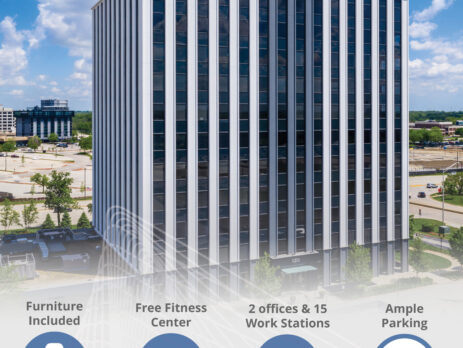

Plug and Play Sublease in Oak Brook, IL

Click Here to see the full flyer Property Summary 1,249 SF Ample Parking Term: 6/30/2023 Rent: Negotiable Furniture Included Free Fitness Center MJ Resutaurant on site Across the street from Oak Brook Commons Contact: Morgan Mellske 312-914-2029 morgan@tmg-rea.com